Changes to be made to government tables as of July 1, 2017

Varennes, June 2017

As announced by the Canada Revenue Agency (CRA) in the T4032 Payroll Deductions Tables, available on the CRA website, changes to income taxes were announced for Prince Edward Island and Saskatchewan.

The Prince Edward Island budget will increase the basic personal amount to $8,160 for the 2017 taxation year. Since $8,000 has been used for employees for the first six months of the year, a basic personal amount of $8,320 will be applied for the remaining six months, starting with the first payroll in July.

The Saskatchewan budget announced changes to the personal tax rates effective July 1, 2017. The rates will be changed from 11, 13, and 15% to 10.5, 12.5 and 14.5% respectively.

This edition of maestro*EXPRESS wil guide you in the process of updating the settings used to calculate payroll. We are providing the amounts to be used for reference purposes.

|

We recommend that you carefully check the amounts that you enter in maestro* to ensure they are correct for your specific situation. It is your responsibility to confirm the rates and keep yourself informed of any changes. |

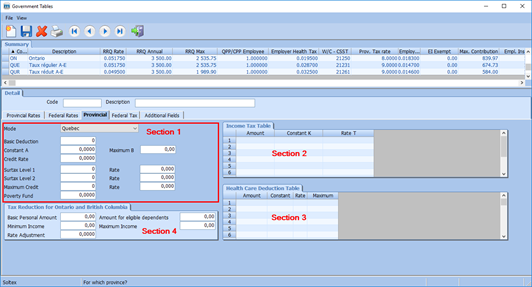

| maestro* > Time Management > Maintenance > Payroll >Government Tables |

- In the Summary section, select the province Code.

- In the Detail section, Provincial Tax tab, enter the information in sections 1 and 2, as shown below:

|

WARNING! There are no changes to be made to sections 3 and 4. |

Provincial Tax, as of July 1, 2017

(To complete in section 1)

|

Fields |

Prince Edward Island |

Saskatchewan |

|---|---|---|

|

Basic Deduction |

$8,320 New |

$16,065 |

|

Constant A |

||

|

Maximum B |

||

|

Credit Rate |

0.098 |

0.1050 New |

|

Surtax Level 1 |

$12,500 |

|

|

Rate – surtax 1 |

0.100 |

|

|

Surtax Level 2 |

||

|

Rate – surtax 2 |

Income Tax Table – Indexing of taxable income thresholds

(To complete in section 2)

|

Provinces and Territories |

Amount ($) |

Constant (K) |

Rate (T) |

|---|---|---|---|

|

Saskatchewan |

0 |

0 |

10.50 New |

|

45,225 |

905 |

12.50 New |

|

|

129,214 |

3,489 |

14.50 New |