Changes to the Government Tables Effective July 1, 2020

Varennes,

As announced by the Canada Revenue Agency (CRA) in the T4127 Payroll Deductions Formulas document, available on the CRA's website, modifications to income taxes for the province of British Columbia and Yukon Territory have been made.

This maestro*EXPRESS has been made to guide you through the update of the payroll calculation settings.

|

We would like to remind users that it is their responsibility to validate the appropriate rates and stay updated on any subsequent change. It is therefore recommended to verify the data entered in maestro*. Information included in this document is provided for information purposes only. |

Yukon Basic Personal Amount (BPAYT)

The Yukon Basic Personal Amount (BPAYT) has been changed to mirror the Federal Basic Personal Amount (BPAF).

To adjust for the first six months of the year, a prorated calculation will be applied to the remaining six months, starting with the first payroll of July. The following formula will apply the BPAYT starting July 1, 2020. The prorated amounts in the formula are $14,160 and the factor ($1,862 / $63,895).

Prorated Formula

|

|

* *** |

In maestro*

|

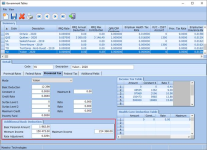

maestro* > Time Management > Maintenance > Payroll > Government Tables |

Upon the download of the 3.04.43.75 or 3.05.24.75 update, a new Additional Basic Deduction section will be added under the Provincial Tax tab, of the Government Tables option, when the Mode field of this tab is set to Yukon.

|

|

|

|---|---|

|

|

1 |

|

|

150 |

|

|

214 |

|

|

0 |

Once done, click on the Save icon, then Quit.

British Columbia - New Tax Bracket

For 2020 and subsequent years, a new top marginal rate of 20.5% is introduced for British Columbia tax filers who have an income over $220,000.

Since employees have been taxed at different rates for the first six months of the year, a prorated tax rate will be applied for the remaining six months, starting with the first payroll of July. Starting July 1, 2020, the prorated rate will be 24.2% for incomes greater than $220,000, and such until December 31, 2020.

In maestro*

|

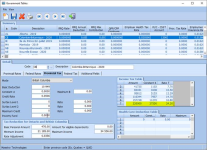

maestro* > Time Management > Maintenance > Payroll > Government Tables |

A new line will have to be added to the Income Tax Table, under the Provincial Tax tab, of the Detail section.

|

|

|

|---|---|

|

|

220 |

|

Constant K |

27 |

|

|

24 |

Once done, click on the Save icon, then Quit.

You can consult the following maestro*EXPRESS to view all payroll changes for 2020: Payroll Modifications Effective January 1, 2020.

For more information concerning these changes, please visit the Payroll Deductions Formulas - 112th Edition Effective July 1, 2020 page of the CRA's website. You can also consult the following guides, recently updated by the CRA:

- T4032 Payroll Deductions Tables (as of July 1, 2020)

- T4008 Payroll Deductions Supplementary Tables (as of July 1, 2020)

We encourage you to contact Maestro’s Software Support Department by phone at 1‑877‑833‑1897 or by email at support@maestro.ca for additional details regarding the required modifications to maestro*.