Various Payroll Updates for Quebec Employers

Varennes,

New payroll modifications have been in effect or will soon come into force; among the changes:

Increase to the Minimum Wage Effective May 1, 2018

The Quebec government announced an increase to the minimum wage as of May 1, raising the general minimum wage to $12 per hour, and to $9.80 per hour for employees receiving tips. It is highly recommended to verify your maestro* data and make the appropriate changes if necessary.

For more information on this increase, please refer to the press release issued by the ministère du Travail, de l’Emploi et de la Solidarité sociale, available (in French only) on the Québec Portal website: http://www.fil-information.gouv.qc.ca/Pages/Article.aspx?idArticle=2601176219.

Upcoming Update to CCQ Hourly Rates and Social Benefits

Again this year, changes will be made to some of the rates set by the Commission de la construction du Québec (CCQ). Though they have not yet been made public, we know that the modifications will be effective April 29, 2018. On that date, we therefore encourage you to download the hourly rates to maestro* as described in How-to Updating CCQ-Related Data in maestro*.

You may also refer to the CCQ website at www.ccq.org/en/ for additional information, or contact the Maestro Customer Support team – by phone at 1-877-833-1897 or by email at support@maestro.ca – for details on applying these changes in maestro*.

Reduction of the Contribution to the Health Services Fund Since March 28

The minister of Finance delivered his Budget Speech for 2018-2019 on March 27, 2018, and announced a gradual reduction of the Health Services Fund contribution rate for all Quebec small and medium-sized businesses (SMEs).

- For SMEs in the primary and manufacturing sectors, the minimum rate went from 1.50% to 1.45%.

- For SMEs in the Services and Construction sectors, the minimum rate decreased from 2.30% to 1.95%.

Changing the Health Services Fund Contribution Rate in maestro*

|

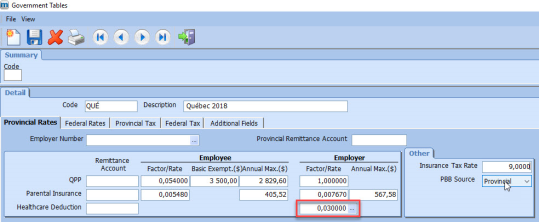

maestro* > Time Management > Maintenance > Payroll > Government Tables |

- Under the Detail tab of the Government Tables window, select the Code for the province of Quebec in the appropriate field.

- On the Provincial Rates sub-tab, enter the new rate using a decimal format in the Factor/Rate column of the Employer section for the Healthcare Deduction field.

- Click the Save icon, then Quit.

Please review pages 49 to 59 of the document 2018-2019 Budget – Additional Information for detailed information on past and future changes to the Health Services Fund contribution rate.

|

It should be noted that it is the users’ responsibility to validate whether they have the correct government constants, wage and social benefit rates, union contributions, and Commission de la construction du Québec (CCQ) taxable benefits, and to stay current on any subsequent modification. |