Union and Monetary Contribution Modifications for CCQ Employees Starting December 29, 2019

Varennes,

To all maestro* clients and users,

Modification to Pension Plan Union and Monetary Contributions

|

Maestro* does not automatically update unions. For information on how to update unions, please refer to the How To Update CCQ-Related Data in Maestro*Update CCQ-Related Data in Maestro*, in the Modifying Union DuesModifying Union Dues section. |

So as to be aware of the new contributions, please consult the CCQ's Union Dues Rates Web page.

New Rates for Taxable Benefits

Since the insurance plan is paid in full by the employer, it represents an advantage for employees and, therefore, must be taxed. Thus, health and life insurance are considered a taxable benefit for provincial tax, whereas only life insurance is considered as such for federal tax. At a provincial level, Revenue Quebec requires of employers to consider this taxable benefit when they perform their source deductions, but only to calculate the amount of tax to deduct.

Starting December 29, 2019, employers will have to add the new hourly rate by trade and activity sector, or by salary annex (i.e. lineman) to employees' base salary, in order to determine the amount of tax to deduct at the federal level. The Canada Revenu Agency does not require from employers to consider life insurance taxable benefits when calculating their source deductions. The CCQ sends a T4A slip pamphlet to all employees, indicating the amount of this taxable benefit. If an employer also indicates a taxable benefit on the T4A slip given to an employee, that said employee will be doubly charged.

To know the new applicable rates starting December 29, 2019, please consult the CCQ List.

Download Social Benefits in mastro*

|

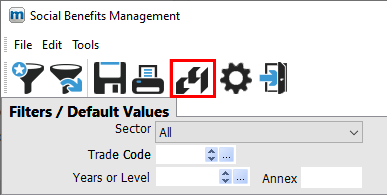

maestro* > Time Maintenance > Maintenance > Payroll > Social Benefits Management |

|

The complete procedure on how to update social benefits directly in maestro* is explained in the How To Update CCQ-Related Data in Maestro*Update CCQ-Related Data in Maestro*, in the Updating Social BenefitsUpdate Social Benefits section. |

To note all information concerning what is announced in this maestro*EXPRESS (and more), consult the Bâtir, Winter 2020 Edition document.

For more information concerning the required modifications to be made in maestro*, please contact Software Support through the maestro*GUIDE portal or by phone at 1-877-833-1897.

The Maestro Team