Annual CCQ Wage and Social Benefits Rates Changes

Varennes,

In compliance with the collective agreements in effect for the four sectors, the Commission de la construction du Québec (CCQ) recently announced rate changes on its website. These changes will have to be included in May 2019’s monthly report, which starts April 28, 2019.

The rates update, made available last Thursday, must be done outside business hours or over the weekend. The required steps are listed in the How-To document Updating CCQ-Related Data.

Details on the various rate modifications are available by clicking the links below:

Changes also need to be made to Indemnities related to security equipment. Unlike wage rates and contributions, these indemnities cannot be automatically updated in maestro*. A premium must first be created in the Define Earning/Deduction Codes option, after which the premium needs to be linked to the corresponding trades in the Define Trades option.

For more information concerning the required modifications to be made in maestro*, please contact Software Support through the maestro*GUIDE portal or by phone at 1-877-833-1897.

|

We would like to remind users that is is their responsibility to validate the appropriate rates and stay current on any subsequent change. It is therefore recommended to verify the data entered in maestro*. Information included in this document is provided for information purposes only. |

Wage Rates

Civil Engineering and Roadwork

- Wage rate increase of $0.50 for the ironworker in annexes D5, D8, and F3.

- Salary catch-up of $0.05 for operators defined in 1.01 25) in annexes D4, D5 D7, D8 F2, F3, G2, G3, T4, and T5.

- Salary catch-up of $0.10 for various trades (except those in 1.01 25 and a few more).

Contributions to Social Benefits

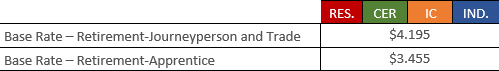

Retirement Plans

Employer Contribution Rates

Employee Contribution Rates

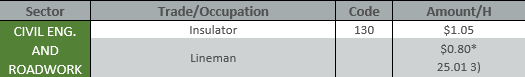

Indemnities related to Security Equipment

* Only modified trades and sectors are displayed in this table.

** If the employer does not supply the safety harness, this hourly indemnity must be paid to the employee.

This type of indemnity must be paid using a premium that will be applied manually when applicable.

To create or modify the premium:

|

maestro* > Time Management > Maintenance > Payroll > Define Earning/Deduction Codes maestro* > Time Management > Maintenance > Payroll > Define Trades |