Payroll

|

Throughout the years, Maestro has developed several options and functionalities to meet its customers’ needs in terms of payroll. A variety of methods can be used to carry it out and addition manage fringe benefits, whether the payroll is processed in-house or done by a third party through outsourcing. |

|

As Maestro* enables the daily management of a company’s operational and financial data, it can link hours charged and allocated to projects and those that need to be paid to employees. Just like all our other modules, the Payroll module is integrated.

SUMMARY

- In-House Payroll Processing

- Outsourced Payroll Processing

- Allocating Worked Hours to Projects BEFORE Payroll is Produced by a Service Provider

- Scenario No. 1(only importing accounting entries without balancing fringe benefits)

- Scenario No. 2 (importing accounting entries and payroll data while balancing fringe benefits)

- Allocating Worked Hours to Projects AFTER Payroll is Produced by a Service Provider

- Maestro* Importation Methods

- Allocating Worked Hours to Projects BEFORE Payroll is Produced by a Service Provider

- Deductions and Earnings Processing in maestro*

- Reminder

- Food for Thought – Preparing the Payroll Implementation

In-House Payroll Processing

The first step of the payroll process, when it’s done in-house, is entering worked hours. Since maestro* enables dispatching hours per day, users can monitor project costs at all times. To obtain the most accurate project costs possible and ensure the accuracy of the accounting data, it’s essential to record social benefits – called fringe benefits in maestro*.

| Fringe Benefits(FB) The term Fringe Benefits is used in maestro* to describe all employer costs or expenses that are added to a salary to benefit employees. Simply put, fringe benefits correspond to what are commonly called social, employee, or marginal benefits. |

Balanced Mode (or calculating payroll while balancing fringe benefits between payroll and projects)

When the balanced mode is used to process payroll, it indicates that maestro* records fringe benefits for the current payroll. All worked hours are paid and all paid hours are linked to one or several project(s).

Considering fringe benefits amounts are not yet known, an estimated rate can be defined at the work category level. As a result, the employee’s salary amount AND the estimated fringe benefits rates are allocated to the project. When the time comes to process payroll, the project-dispatched hours are automatically imported to payroll where adjustments can be made, such as adjusments to banked hours management or applying default hours for employees that didn’t complete their timesheet. It is also possible to run an option that verifies if overtime should be added before processing the actual payroll. This can prove itself useful when some employees work irregular schedules. They may not have done overtime on a daily basis, but could have over a pay period’s total hours. Once all hours have been processed by payroll and the latter has been completed, the fringe benefits amounts applicable to payroll for each employee are now available. All entries previously allocated to projects can then be corrected and posted accordingly.

This method enables posting project hours on the date they were carried out; because the salary expense is posted when it is incurred, the resulting financial statements are much more accurate. It also saves time when a pay period overlaps different financial periods; no manual adjustement is required. Additionally, the application of a temporary cost (salary plus estimated fringe benefits rate) affects projects and allows users to benefit from significant project costs. The temporary cost is then corrected when the fringe benefits are adjusted.

| The Overtime Calculation option facilitates calculating hours that are paid overtime or double rates. The calculation is based on predetermined rules and simplifies the payroll processing for the paymaster (for instance, when payroll needs to be completed for over a hundred employees). |

Normal Mode (or calculating payroll without balancing fringe benefits between payroll and projects)

Although this method is not used as much by companies, processing payroll in maestro* using the normal mode means that all costs pertaining to fringe benefits are managed as temporary costs. However, in reality, maestro* allocates the actual fringe benefits from the previous pay without balancing them between projects and the current payroll.

To use the normal mode to process payroll, it’s necessary to indicate that hours must be posted directly in the Time Management module's General Settings. The same thing must also be done on the payroll side. The only downside in this case is a probable gap between the estimated fringe benefits rate in the projects and the actual rate in the payroll processing. This creates a residual difference in the Accrued Salaries and Accrued Fringe Benefits accounts which will require periodic manual adjustments.

Outsourced Payroll Processing

Some companies decide to assign payroll processing to an external service provider. In this situation, several methods – all involving both advantages and disadvantages – can be considered. However, before appointing a recognized third party to process their payroll, these companies must take into account that the resulting payroll data will necessarily have to be imported back into maestro* to ensure that project costs are allocated and reflect actual values. Even when an external provider is used, it is still necessary to create and configure employees in maestro* as well as enter the information related to hourly rates, unions, etc.

| Since its beginnings, Maestro has supplied interfaces more or less developed to transfer hours and/or process payroll with the following providers:

|

Allocating Worked Hours to Projects BEFORE Payroll is Produced by a Service Provider

Scenario No. 1

- Only importing accounting entries

- Without balancing fringe benefits between Payroll and Projects

When payroll is processed by an external provider, it often results in delays before the salary costs are linked to projects; the duration of the entire payroll process depends on the provider. To address this situation, Maestro offers an alternative which is to allocate salary expenses to projects progressively, as they are incurred, offset by accrued salary (liability account). In addition to producing an updated financial management at all times, this method enables:

- automatic hour compilation to generate the export file for the external provider;

- intercompany management if needed;

- accurate management of banked hours;

- automatic financial adjustment when pay periods overlap two months;

- accurate and updated project costs.

Although each provider has its own distinctive features, this procedure’s resulting actions are generally as follows:

- Dispatch hours in maestro* projects;

- Export worked hours to the external provider;

- Payroll processing completed externally;

- Import accounting entries back into maestro*.

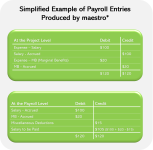

There may still be gaps between the data initially entered in maestro* and the imported entry, which is why some adjustments may be required. Users may also notice that this method doesn’t include a step that balances project fringe benefits with the actual payroll fringe benefits. The procedure thus consists of an hour entry in maestro* followed by an export where hours are compiled per employee (i.e. no project-related information is provided). Indicating hours for all employees is crucial, even administrative employees. A timesheet must therefore be completed by everyone, without exception. Once the payroll process is finalized, the external payroll service normally produces a general accounting entry that is imported into maestro*; this entry contains various deductions (such as government remittances). It is essential to ensure that this entry’s salary accounts match the accrued salary and fringe benefits accounts used in projects. Where salary rates are the same (both in maestro* and the system used by the external provider), salary amounts should cancel each other out. If not, the ensuing gap must be identified as it will help in finding the origin of the configuration error. As mentioned previously, a slight gap may remain between the fringe benefits estimated in the projects and the actual fringe benefits amount. An adjustment entry is then required.

Scenario No. 2

- Importing accounting entries and payroll data

- Balancing fringe benefits between Payroll and Projects

When the external payroll system allows it, it can be interesting to import into maestro* both the accounting entry and the employees’ pay. In addition to enabling the employer to directly view the salaries paid to its employees without resorting to reports or referring to the service provider, this method allows the use of the functionality that reconciles fringe benefits between project and payroll. It ensures there are no cumulative gaps in the accrued fringe benefits account.

The actions resulting from this method are generally as follows:

- Dispatch hours in maestro* projects;

- Export worked hours to the external provider;

- Payroll processing completed externally;

- Import salaries into the maestro* payroll module;

- Reconcile fringe benefits between projects and payroll;

- Import the accounting entry into maestro*.

| It is also possible to use the maestro* financial transfer functionalities to make adjustments when the detailed payroll – which consists of both the salaries and fringe benefits – is imported. This approach is more complex and requires that the information of the external system be available. It does nonetheless prove itself to be highly interesting, especially if an external service is used to process American payroll. |

Allocating Worked Hours to Projects AFTER Payroll is Produced by a Service Provider

Some companies decide not to enter hours in maestro* before sending them to the service provider. Hours are compiled through an Excel spreadsheet or using a tool distributed by the provider. Payroll is then processed and the resulting entry, which contains the cost breakdown per project, can be entered into maestro*; salary costs are consequently allocated to the appropriate projects. All things considered, this method delivers the expected results, although with some limitations: loss of information regarding employees who worked on various projects together with a significant delay between the moment costs are incurred and when they are finally allocated to projects.

Maestro* Importation Methods

When the employer starts by entering payroll data using an interface or the provider’s software, the provider is responsible for the entire payroll processing and afterwards sends an import file so that the processed data is transmitted to maestro*. Importing the data in maestro* is done through an Excel file. Data can be imported per project, employee, or all employees at once. An importation template will however have to be supplied by the client to ensure that the payroll provider returns the appropriate variables in a predetermined order after completing the payroll process.

Deductions and Earnings Processing in maestro*

Occupational Health and Safety Deductions

In Canada, employers must pay the deductions related to the financing of the occupational health and safety scheme which permits, among other things, compensating employees that have been exposed to occupational injuries. In maestro*, occupational health and safety deductions can be managed at either the project or payroll level. The rates pertaining to those deductions are set by various organizations such as the Commission des normes, de l'équité, de la santé et de la sécurité du travail in Québec (CNESST), the Workplace Safety & Insurance Board (WSIB) in Ontario, the Workers Compensation Board (WCB) in Manitoba and Alberta, etc.

| It is important to remember that the payment of provisions is compulsory for Quebec employers. Although the actual amount of health and safety deductions to be paid is calculated at each pay, according to the rates entered in maestro* and prescribed by the CNESST, Quebec employers are required to pay installments. Indeed, as the number of workers and hours worked can vary considerably from one season to another and cause deficits in certain cases, it has been established that provisional amounts must be paid throughout the year. This characteristic distinguishes Quebec employers when it comes to processing health and safety at work premiums. In addition, the amounts of occupational health and safety deductions payable (actual and provisional) are calculated, in maestro*, according to surpluses which can be configured as being annual or weekly. In practice, however, only the salaries of jobs subject to the CCQ have a maximum weekly contribution. |

Processing at the Project Level

Managing the occupational health and safety deductions at the project level allows for the association of an employee’s worked time to one or several W/C - CSST activities, each of the latter being linked to classification units. An employee can therefore be assigned to several activities during a single week, even sometimes within a single work day. This results in very accurate processing for situations where, for instance, an employee performs various tasks for a specific project.

Processing at the Payroll Level

When occupational health and safety deductions are managed at the payroll level, it means that the classification units are linked to trades and/or work categories. Once worked hours are entered in maestro*, the trades or work categories of the affected employees generate salary amounts for the related classification units.

Miscellaneous Earnings

Maestro* provides the opportunity to create different types of earnings. It is possible to indicate if all or any of them are subjected to withholding taxes and contributions, and if so, based on which proportion:

- Income

- Bonuses

- Commissions

- Child/Spousal Support

- Deductions

- Expense Reimbursement

- Vacation

- Earnings

|

o | How are labour costs integrated into your projects? |

o | Do you wish to calculate the actual payroll cost including the calculation of fringe benefits? |

o | Is your payroll processing attributed to an external service provider? If so, which one? |

o | Do your company’s activities take place in one or several provinces? Are your employees likely to work in more than one province? |

o | Are you planning on using the US payroll or submitting certified pays? |

o | How many employees are usually on the payroll list (minimum and maximum)? |

o | When are your employees paid (weekly, biweekly, etc.)? |

o | What earnings can be attributed to your employees during a year? |

o | Do you manage:

|

o | Do your employees benefit from special deductions? |

o | Do you manage banked time? |

o | How do you recuperate employee advances, if applicable? |

o | How are vacation hours accumulated? |

o | How are vacation hours paid? |

o | Do some of your employees work for more than one trade? |