Define Tax Code Usage

OBJECTIVE

The Define Tax Code Usage option allows users to define formulas that serve to establish default tax codes, rates and accounts in the various invoicing and purchasing modules of maestro*. The 26 tax codes configured in the Tax Code Table can be defined through this option to apply by default or in a different way to a specific situation, which is established by the formula.

As soon as a formula is created, maestro* applies the tax codes, the various rates and customized general ledger accounts to the transaction entry windows with values that correspond to the keys (or variables) defined in the applicable formula. To visualize the options where the Define Tax Code Usage option applies, consult this note.

|

If no formula has been defined in the Define Tax Code Usage option for the type of transaction or if a formula is applicable but no key corresponds to the transaction data, the taxes will apply like usual (that is, according to what has been configured in the Tax Code Table). Consult the appendix for an example of how to use the Define Tax Code Usage option. |

PREREQUISITE

Steps

|

maestro* > Accounting > Maintenance > Accounting > Define Tax Code Usage |

Create a formula

- Enter the required information in the Parameters section:

Fields in the formula and in the distribution grid vary according to the Module and Type of Transaction selected.

If the Management of US Sales Taxes is activated in the Configuration of the General Ledger, under the Management of taxes section, it is not possible to select the Billing module. In fact, Management of US Sales Taxes implies a different functioning for tax application, which must not be modified by the Define Tax Code Usage option. For more information on the subject, consult the help on Define Tax Autorities and Define Tax Codes.

Field

Description

Module

Allows the user to identify the module that the tax formula applies to.

Transaction Type

Allows the user to determine the type of transaction involved.

Billing

Sale

Affects the Enter a Sale, Invoice Preparation (W/O) and Release Holdback options.

Concrete Tickets

Affects the Ticket Invoicing - Concrete and Advanced Concrete Ticket Invoicing options.

Contractual Billing

Affects the Contract Invoicing, Prepare Progress Billing, Invoicing (cost plus) and Release Holdback options.

Invoicing of Customer Orders

Affects the following options:

- Customer Orders;

- Shipping;

- Invoice Customer Orders;

- Rental Orders;

- Shipping of Equipment Rental;

- Invoice Rental Orders.

Service Call Invoicing

Affects the Invoicing and Combined Invoicing options.

Purchasing

Project Purchase

Affects the Project Purchase and Batch Project Purchase options.

Order Management Invoicing

Affects the following options:

- Purchase Order Management;

- Stock Order from Catalogue;

- Subcontract Management;

- Receipt of Goods;

- Purchase Order Invoicing.

Payroll

Bonus Code

Affects the following options:

- Enter Hours;

- Time Sheets;

- Enter Work Orders;

- Distribute Hours;

- Return From a Service Call.

Quotation

Catalogue items, Subcontractors or Resources Cost

Affects the Estimating option for the sections that involve costs.

Catalogue items, Subcontractors or Resources billing

Affects the Estimating option for the sections that involve invoicing.

Formula Prefix

Alphanumeric code that makes it possible to limit the use of a formula to one or more types of transactions.

NOTES: A given formula can be used in multiple modules with the same rate and the same accounts if no prefix is defined. If a value in the formula is changed, such as the GL account, rate or tax codes, all the modules to which the same formula is applied will be affected.

To prevent identical formulas from sharing values that must remain separate through the different modules or transaction types, the user must enter a different prefix for each of the defined formulas.

Formula

Allows the user to define the fields for establishing the tax formula. Variables differ according to the Module and Transaction Type selected.

- Click the ▼ icon to display the different possible variables.

- Check the variables that will be used to make up the formula.

- Click Ok to save.

NOTES: Variables need to be defined from the most general to the most precise. That is, they must form some sort of funnel filter. For example, for a formula applicable to Contractual Billing transactions, it would be preferable to define it starting with the Province variable, followed by the Contract No., since the province is a more general variable.

The most general variable must be the first of the list. It is possible to move the fields according to their priority by clicking the arrows situated right of the selection of variables window.

Only one formula by Transaction Type is allowed.

In multidimensional mode, formulas are applicable to all the companies.

- Enter the required information in the Keys used for formula. section:

The grid adjusts to the Module, the selected Transaction Type and the Formula.

Field

Description

Key

Key created according to the selected Module, Transaction Type and Formula.

NOTES: If the field on which the tax formula is based has been entered in different ways in the master files, it would be preferable to standardize them before using the Tax Code Use Management.

The key’s first column corresponding to the formula must always be filled since it constitutes the most general value.

Suffix

Alphanumeric code used to identify and distinguish tax configurations that can be used manually in certain circumstances. For example, in a situation where it is impossible to define an automated formula that will cover all cases.

These configurations will not be present by default in the various transaction entry screens. The user can access them manually by the research function (F7) and the Tax 1 and Tax 2 fields of the various options where the Define Tax Code Usage applies.

Shared

Column completed automatically by maestro* that indicates if the tax formula is used in another module. If so, the box is checked.

NOTE: If a value in the grid is modified, such as the GL account, rate or tax code, all modules to which the same formula applies will be affected.

French description

French description identifying the key.

English description

English description identifying the key.

Sale (or Purchase) – Tax 1 (or 2)

These values represent the different configurations given to a tax.

Code

Identify the tax code that will be used from the 26 codes of the Tax Code Table.

Rate

Tax percentage.

NOTE: If no tax rate is entered here, maestro* uses the percentage defined in the Tax Code Table. Do not enter a tax code if the objective is to solely define a default tax code.

Account No.

Enter the general ledger account used to total the calculated tax amounts.

NOTES: If no account is defined here and a transaction is created, maestro* checks for an account number in the Tax Code Table and if an account number is found, maestro* uses it.

If no account is defined in the Define Tax Code Usage option nor in the Tax Code Table, the tax is taken into account in the purchase or sale price. This method is used when there are no recoverable taxes.

% Recoverable

Allows the user to enter the percentage of recoverable tax.

NOTE: For example, 50% of taxes can be recovered for entertainment expenses; in that case, 50% should be entered. This option only works with included tax codes.

Identification

A text field that makes it possible to identify the key and that can be used in the list generator.

If no value has been entered in the Rate, Account No. and % Recoverable fields, the values entered in the Tax Code Table will be used.

It is possible to save a formula without tax codes so that no taxes are applied if a transaction meets certain predefined conditions. The Code, Rate, Account No. and % Recoverable columns must be empty to ensure the tax is not calculated.

- Click Save.

Modules or options where the Define Tax Code Usage option applies:

- Sale (Concrete Tickets type);

- Enter a Sale;

- Invoice Preparation (W/O);

- Prepare Progress Billing;

- Contract Invoicing;

- Cost Plus – Invoicing;

- Estimating;

- Project Purchase;

- Batch Project Purchase;

- Subcontractor's Order;

- Purchase Order Management;

- Stock Order From Catalogue;

- Receipt of Goods;

- Work Order Review;

- Enter Hours;

- Time Sheets;

- Enter Work Orders (Hours tab, for bonuses only);

- Distribute Hours (Service Management);

- Return from a Service Call;

- Release Holdback (Invoicing and Contractual Billing);

- Customer Orders;

- Shipping and Invoice Customer Orders;

- Rental Order (Equipment Rental Orders);

- Shipping of Equipment Rental (Invoice Rental Orders);

- Invoicing and Combined Invoicing (Service Management module).

APPENDIX

Example of configuration of tax codes for invoicing customers outside of Quebec

An invoice must be issued for a project that will be carried out of the Province of Quebec, in the State of Maine. Taxes to invoice differ from the delivery address of the project, to the customer’s address, to the state where the project is conducted.

|

This hypothetical example is presented for information purposes only; the rates are fictitious. |

Steps

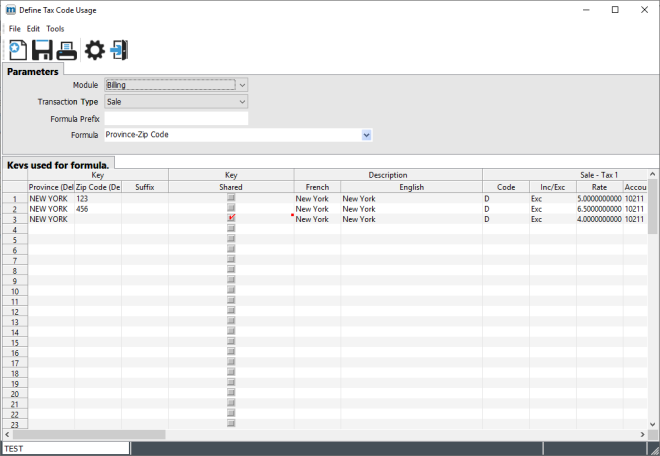

- Select the Module and the Transaction Type. In this situation, the module is Billing and the Transaction Type is Sale.

- Click the formula and select the Province-Zip Code formula.

Use the up or down arrows to position the most important field on top. Here, the province followed by the zip code.

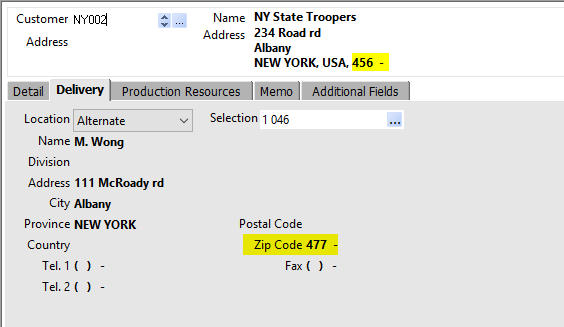

In this situation, maestro* validates the zip code specified in the Delivery tab of the Enter a Sale option when entering the transaction. Therefore, if the delivery address is the customer’s, maestro* considers the customer's zip code. If the delivery address is the project’s, maestro* considers the project's zip code.

- Fill in the breakdown grid according to the various zip codes and rates to apply to the New York State. In the following case, a tax has been defined for a zip code starting with 123, another one for a zip code starting with 456, and one to apply by default to the State of New York.

Text format in the Province field must be entered the same way that it is found throughout maestro*. For example: Québec, Quebec or QC.

For some variables, it is possible to enter a partial value. This allows maestro* to research all the elements starting with this partial value. For example, zip codes starting by 123 or 456.

- Click Save.

Result

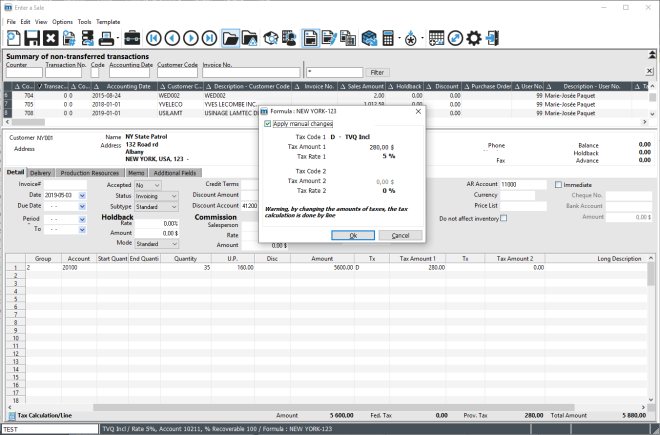

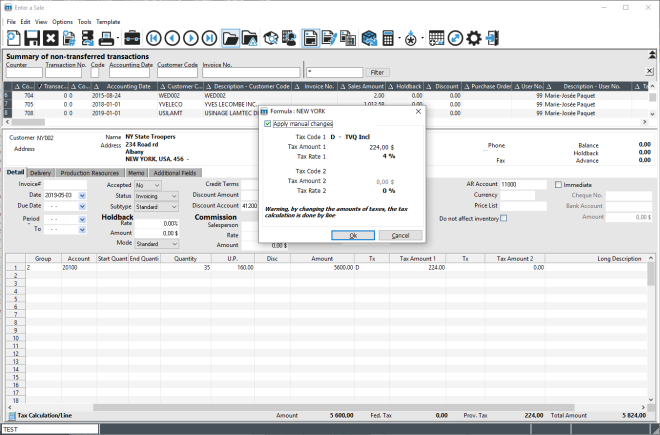

When entering a sale in Enter a Sale:

If the delivery address is the customer’s and that it does not have a zip code, or that its zip code is different from the ones configured in the Define tax Code Usage option, but it is located in the state of Maine, maestro* applies the 4% rate.

|

When the cursor is positioned on the tax code, the information relative to the tax calculation is displayed in the status bar at the bottom of the screen. When pressing the CTRL+F7 key, the formula window opens. It displays the tax formula used as well as the code, showing the amount and the tax rate applied. |

If maestro* finds a match with the customer's delivery address, such as a zip code that starts with 456, it applies the 6.5% rate.

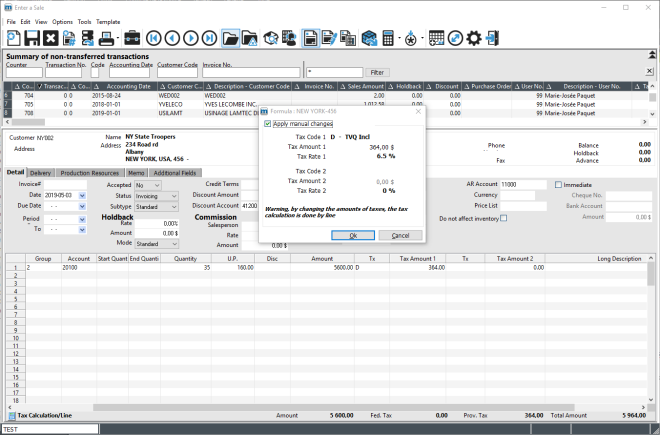

If maestro* does not find a match with the zip code of the Delivery tab, for example in a case where the delivery address would be different from the customer’s (in the example below, it is the project’s), maestro* searches with the upper level variable. Here, the province.

Maestro* applies the 4% rate, not the 6.5% one, since the zip code for the delivery address does not correspond to the zip codes indicated in the Define Tax Code Usage option, but the project is still in New York.

Last modification: August 16, 2025